About Us

- Home

- About Us

Who We Are

As an organization driven by solutions, we specialize in addressing complex financial challenges, working closely with senior management to structure transactions that balance risk and reward.

Our mission is to deliver on our commitments with clarity and predictability, aligning with our belief in being part of the profit centre, not just a cost.

What We Do

At BK Management Solutions Pvt. Ltd, we provide a one-stop solution for all your financial needs. Our services include Debt Capital, Mezzanine Capital, Equity Capital and Mergers & Acquisitions (M&A) Advisory.

Our expertise spans various sectors, including NBFC, Solar, Wind, Defense, Railways, Pharmaceutical, Chemicals, Infrastructure, Manufacturing, EV, and the Capital Market segment.

Debt Capital

BK Capital Slice the transaction with respect to the end use, tenor, cashflow streams and create the debt size suitable to be under as per regulatory requirement of RBI.

Mezzanine Capital

Our mezzanine financing bridges the gap between debt and equity, offering flexible solutions like convertible instruments and preferential issues to optimize your capital structure. It takes the flavour of Debt or equity based on certain milestones or episodes.

Equity Capital

BK Capital's equity services encompass understanding business model, peer group landscape, growth driven to ascertain the range of fair value for the company’s health. Selecting fund raise strategies like IPO, QIP, Preferential rights issue, warrants etc. ensuring the right mix of structure best suited for your business growth.

Mergers & Acquisitions (M&A) Advisory

We provide expert M&A advisory, from identifying the buy side or sale side targets, handhold the due diligence process, Valuation and swap ratios, fund raising for the buy side, post-merger integration ensuring seamless transactions and maximizing value.

Our Methodology

1. Lead

Generation

We identify the lead which reflects lenders and investors current need of potential exposure.

2.

Management

Meeting

3.

Screeening the

requirement

4.

Feedback from

Investors

5.

Deal

Structuring

6.

Deal

execution

Tracking performance and sector developments to ensure alignment with our future

financial philosophy.

7.

Monitoring

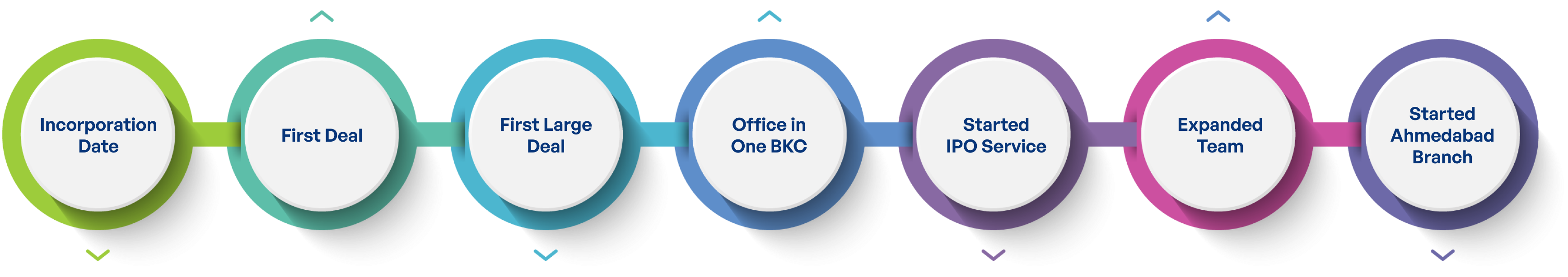

Our Journey

Than we grace to structure fund/mezzanine funding and expanded coverage to AIF/Special Situation Fund/Performing Credit Fund/Special Opportunities’ Fund.

Milestone

06-04-2010

(Date and Amount)

(Date)

(Date)

(Date)

(Date)

(Date)

Our Vision, Mission,

and Values

Inspired by the legacy of our founder's mother, our vision, mission, and values are deeply rooted in ethical practices and a commitment to excellence.

Our Vision

To provide strategic financial advice and innovative solutions across capital structure through customised deal solutions.

Our Mission

Long term relationships with all stakeholders. (Issuers, Investors, Borrower’s, Lenders and Team) and to be part of entire financial ecosystem.

Approach & Values

Our values form the backbone of BK Capital's vision and mission. They inspire us to create lasting value for our clients, build enduring relationships, and lead with purpose in every endeavour.

Integrity: We are committed to transparency and ethical practices, ensuring all transactions are conducted with full integrity.

Meet The Team

CSR Activity

Culture

Our team culture emphasizes collaboration, respect, and the celebration of diversity. Photos from our Diwali and Holi celebrations highlighting our vibrant and inclusive workplace.